Helping NZ Professionals Optimise Wealth Since 2011

Financial Planning | Investment, KiwiSaver & Property Strategy | Life, Income & Health Insurance Protection

Helping NZ Professionals Optimise Wealth Since 2011

Financial Planning | Investment, KiwiSaver & Property Strategy | Life, Income & Health Insurance Protection

Financial certainty isn't a dream, it's a destination. I guide you on this journey, turning complex financial concepts into clear, actionable strategies to help you grow wealth.

Chris George | Financial Adviser

“Chris George is an exceptional financial adviser. He has been instrumental in helping me set up a solid financial plan, and the results have been great. What sets Chris apart is his ability to turn complex financial concepts into clear, actionable strategies. He brings a deep understanding of investment, KiwiSaver, insurance, and retirement planning, which he tailors to fit individual goals and aspirations. His approach is not just about numbers, it’s about aligning financial decisions with what matters most to you.”

Results

We have been offering our financial services for over a decade and and a half. We pride ourselves on a truly bespoke, client-first approach.

When comparing our client satisfaction and retention results against the industry standard, our service has exceeded and outperformed the average by a large margin. We measure this with several metrics but to summarise, see below.

These metrics are updated quarterly:

Percentage of people that move forward on our recommendation: 94%.

Life & Health Insurance client retention rate: 97.4%. A persistency rate of 80% to 85% or higher is generally considered "good" for an insurance book.

Investment client retention rate: 99%. A "good" client retention rate for established financial advisors is typically between 95% and 97%.

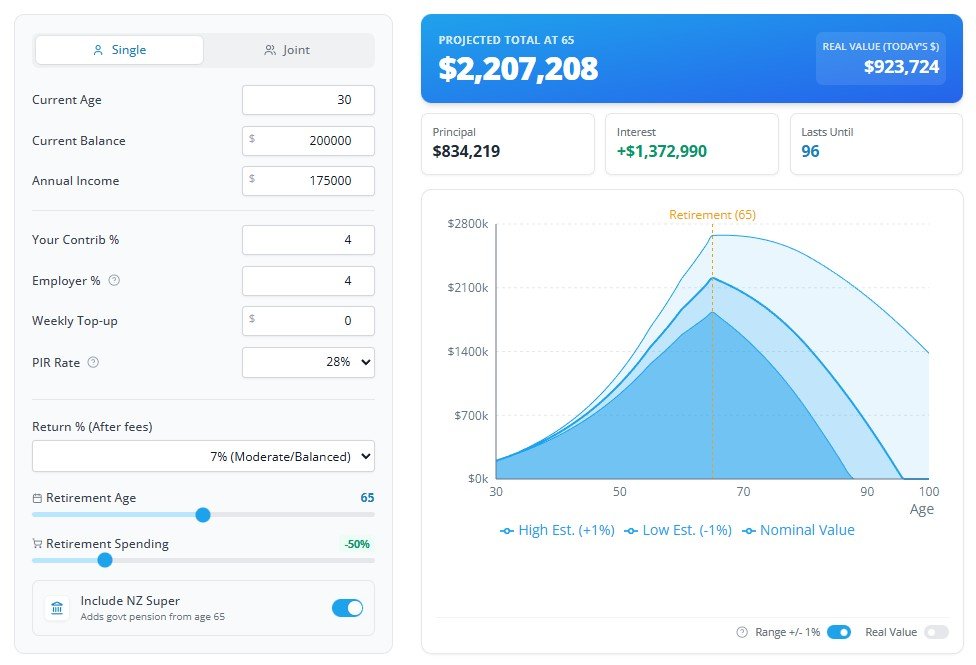

The Ultimate KiwiSaver Planner

Utilise this free advanced calculator to plan how your hard earned savings can grow to optimum levels and last throughout your retirement years.

Calculate how many years your current savings will last if you maintain your current burn rate. Understand the levers you can pull which make all of the difference to your end results for retirement goals.

Learn the fundamentals so you can live the life you’ve always dreamt of.

Understanding KiwiSaver Performance

Watching this video will help you save substantially more for your retirement by focusing your attention on one simple concept that’s commonly overlooked.

To optimise your savings for retirement, we want to maximise returns, minimise risk, and create certainty to prevent stress which can lead to bad decisions.

This video reveals how a couple could accumulate an extra $1,200,000 in KiwiSaver over the next 25 years, without increasing their contributions or risk.

Achieving The Ultimate Retirement

We’ve been successfully helping people create a better future since 2011. We achieve this by modelling the best route to get you to where you want to go.

This video reveals how to:

Ensure your investments and insurances fit your goals

Establish whether to pay down debt or invest more

Create peace of mind for your financial world

Investment Property 101

We help you align your investment property ambitions with your retirement plan.

Narrowing down the vast array of investment property options to ensure you are buying the right type of property in the right location, with the right metrics for your goals.

This guide reveals how to increase your retirement nest egg potential, understand the power of leverage, maximise growth potential, and mitigate the risk of owning investment property. Click here to read.

Calculating Protection Needs

We believe in protecting what you’ve spent so many years building with advanced personal insurance strategies that stand the test of time.

This video will help you understand how to calculate the amount of cover you’d need to prevent financial upset should a health or injury event occur.

This video reveals how to achieve the cover you need, for as little money as possible!

Stop Those Premiums Going Up

It's a fact. Most people aren't aware of their premium options when they buy Income Protection, Trauma, and Life Insurance in New Zealand.

This video will help you understand how to structure the premiums for your cover to save you more, and payout through the period of life when you need it.

This video reveals how to save $10,000's while optimising your Income, Trauma, & Life Insurance.

A Note From Chris

I help New Zealand professionals optimise their financial world and grow their wealth so they can achieve the life they have dreamt of.

I have a fundamental belief in the power of strategic planning to shape our destinies - a sentiment echoed by Benjamin Franklin when he famously stated:

“If you fail to plan, you plan to fail.”

What sets me apart is my practical experience as an adviser. I have successfully navigated the journey of homeownership, successful personal debt repayment, building a diversified property and investment portfolio, along with sustaining a stable business.

This background allows me to provide invaluable insights to others looking to achieve similar goals. You are not working with a newby, you’re working with an experienced adviser that knows what works.

I work with high achievers - professionals, executives, and business owners who want the best for themselves and their families.

Those that understand that a trusted, ongoing relationship with an experienced Financial Adviser is the key to optimising their finances, mitigating the pitfalls, and ensuring financial independence from the system.

Essentially, I help you swap hope for certainty.

My process is thorough, data-driven, and fanatically tailored utilising leading tools and resources.

I put a lot of time into the design of your plan, and do not outsource the delicate background work required to para-planners or administration staff. It's not possible with the level of detail.

This is the approach that delivers the best possible outcome for you and your future.

I'm also completely independent. Instead of measuring success by sales target accomplishments, this advice service focuses on 'customer first' metrics that truly matter. For example:

Client satisfaction

Client retention

Optimised returns

Claims paid, and

Delivering market-leading results

If you're seeking quick fixes or cookie-cutter solutions, this might not be the right fit.

But if you're open to a strategic partnership that can turn your financial world into a solid foundation for lasting generational wealth, I’d be happy to connect.